Innovation in RE deal analysis

- Fabio De Gaspari

- Nov 27, 2020

- 2 min read

Updated: Mar 1, 2022

Coming from the asset management world, my first interface and software has been Bloomberg, the standard in the finance industry with only Reuters challenging some market share. A platform where you can follow markets, read news, make valuation and market studies, chat with broker, close deals and much much more. Excel spreadsheets have always been a fundamental integration where to make deeper analysis and calculus. But Bloomberg has continued to improve during the years, integrating visual tools, improving user experience and continously adding new features and exciting ideas.

In the real estate market, if we consider the world of appraisals, underwriting and deal analysis, we have remained stucked for years in a restricted world of Argus for the big guys and Excel for everyone other. Consider that Argus is a software developed more than 20 years ago, costly and where you need a training to use it! The flexibility and potentiality of Excel have permitted deep analysis and models, with the ability of the modeler to manage complex formulas as the biggest limit.

Just to understand how pervasives are spreadsheets in the real estate industry look at the graph below

My skills developed during the years as financial analyst and a large number of hours spent acquiring specific real estate jargon and concepts gave me the capability to develop bespoke models for different asset classes and deals. Notwithstanding following the market and responding to different request of developer and investors, my passion for Proptech drove me to look for innovator in this niche of the market (but with large money involved!).

So i met a restricted group of innovative companies trying to launch some better tools to analyse real estate deals and provide better transparency and interfaces than handcrafted Excel spreadsheets (that however i love and are a large part of my advisory work).

Here below a list and a brief comment:

Forbury: based on Excel but with an appealing interface, macro and potentialities. Not a jump in the future but honestly seems poweful. www.forbury.com Vote:7/10

Aprao: SaaS software, easy to use and with really clear interface, skewed towards residential products but really fresh air in this field. At this stage limited to development residential finance with some partial integration of commercial/retail units. Vote: 8/10 www.aprao.com

Dashflow for CRE: an innovative platform, particulatly interesting for presentation to commitee or lenders and to fast check deals. Biggest limit is that it works only on iOS. Very prepared team and value proposition. Vote 7.5/10 www.intellect-automation.com

Bigger brands integrate appraisal and valuation within larger suite of products, like RealPage.

If you are a private investors, a broker or a real estate player looking for valuations, sensitivity and scenario analysis for real estate transactions i can provide bespoke solutions and opinions, using tested and appealing Excel models developed for different asset classes and needs. Otherwise i'll be pleased to advise on the better software solution present in the market suited to you.

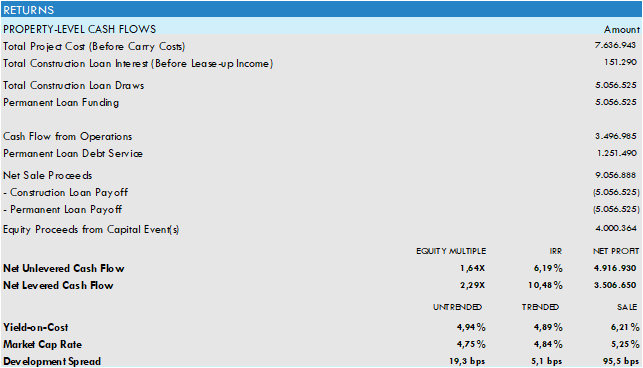

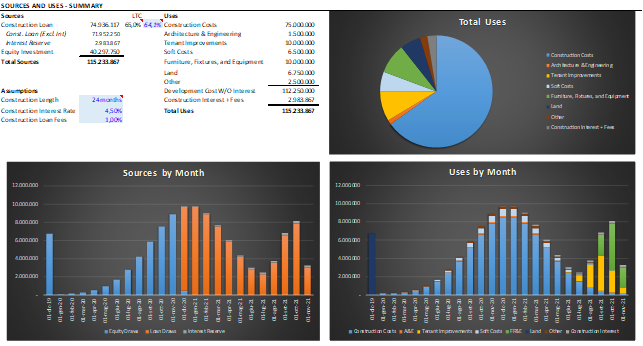

Below some images derived from A.CRE Excel models.

Comments